The recent launch of the UK Shared Micromobility Dashboard has allowed for a closer look at the live situation of bikeshare systems in the UK and how usage and availability has changed in relation to the Covid-19 pandemic. To help with this I have added a column comparing the % of bicycles in the fleet compared with the 2020 maximum.

It is also interesting to contrast how different cities’ bikeshare systems have reacted world-wide, with varying national lockdown policies and different user types have resulted in, in some cases, big increases in usages and, elsewhere, a collapse of usage leading in some cases, unviability.

Bikeshare in Lockdown London

London has 11000 bicycles available for automated hire – down a bit from a maximum of 16000 but still a considerable resource.

In summary: 3 of the 10 systems are operating with normal numbers, 3 have closed completely, and 4 have slashed their fleet to under half their size earlier in the year.

The Santander Cycles docked system is just as large as ever – indeed it normally sees a drop in fleet size as summer approaches, down from ~9500 to ~8500 due to maintenance backlogs and/or optimising fleet distribution, but has instead increased to over 10000 – just short of its record. It has also been seeing very high usage numbers – the good weather is helping, but maybe here it is seen as a safer form of transport for a city where most households in the inner city don’t own a car, bike ownership remains relatively low, and bus, metro and train use is being heavily discouraged.

On the other hand, the two systems in London which have steadfastly failed to release live open data feeds about their fleet locations and availability, namely Lime and Bird (London’s only escootershare) quickly shut down near the start of the lockdown. Both businesses have been struggling in general and have shut down in almost all regions globally.

Jump, on the other hand, has remained operating in London – it has shut down in almost every other city it operates in. The London fleet has reduced however to just 20% of its 2020 maximum. The remaining few bikes are consequently being very heavily used. Mobike, similarly, is still operating but down to just 11% of its numbers earlier in the year.

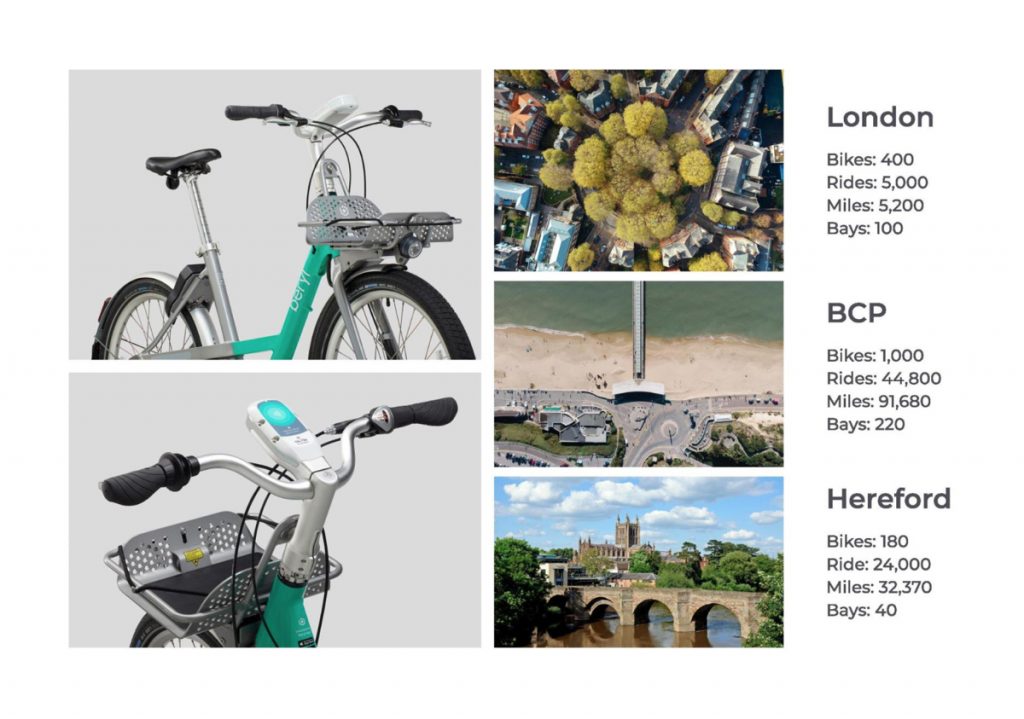

London’s smaller fleets have also reduced in size – Freebike down to 40% of its fleet and operating in a reduced area, and Beryl’s already small fleet down to 26% – Beryl has however launched much larger systems recently in Watford and Norwich, so may be using some of these bikes there.

Finally, the nextbike system in Brunel University and Uxbridge is still running, in contrast to the tiny Kingston University system that has shutdown (which is fair enough, the university itself being almost shut down and university students being the target user). Barnet council’s private system is also still going.

How Bikeshare is Adapting in the rest of the UK

Beryl’s 4 systems in Watford, Norwich, Hereford and Bournemouth are all operating normally. SoBi in Brighton is also seeing normal fleet numbers. Nextbike is more mixed – Cardiff, Stirling, Warwick University and Surrey University are normal, but Belfast, Milton Keynes and Swansea University have closed, and Glasgow is running at half-size, and Exeter is only at 26% of its maximum.

Edinburgh’s Your Bike system is also halved.

Other casualties include Bristol YoBike, the Lime bikes in Milton Keynes, along with Lincoln and Slough, and Oxford and Cambridge Mobike fleets are virtually gone.

Beryl were brave enough to actually launch a new system, in Norwich. It is now the fourth largest system outside of London, due to Edinburgh and Glasgow’s reductions.

Bikeshare Globally in a Covid-19-afflicted World

Some cities are seeing big increases, some are seeing big decreases. This is likely due to different operator policies, system viability, transport alternatives and user profiles:

- Some operators have chosen to reduce fleets substantially so that they can continue to operate with reduced staff or to take into account increased cleaning/disinfecting regimes.

- Financial considerations mean that systems which were losing money and not strongly tied to a public operations agreement will take this as an opportunity to shut up shop and take a breather, maybe to restructure the business.

- Where bikeshare competes with public transit, and the latter’s service is reduced or actively avoided by people social distancing, bikeshare is likely to grow. Conversely, if the private car was the alternative, bikeshare has a weaker case for being a “safer” alternative.

- Tourist-dominated systems will have seen huge drops as there are many few tourists. Utility-dominated systems will however see much less of a drop, as people still need to do the key errands such as shopping or going to work (where allowed). Commuter-denominated systems will see a big drop as there is much less commuting going on. Finally, recreational systems are probably OK as exercise is recognised as an ongoing need in many locked down jurisdictions.