Mobility is a complex and important topic in geography, planning and technology. My research only touches on a small part of the field, namely automated micromobility services (aka micro-MaaS?) such as bikeshare and escootershare, so it’s always interesting to see a wider viewpoint.

As such, I was interested when an acquaintance at HERE Mobility, an autonomous part of HERE Technologies (a major location platform provider), mentioned a new report they’ve recently published, the State of Mobility 2019. While there’s a myriad of information sources on mobility, which has evolved rapidly the last few years, with increasing urbanisation and big technology players funding driverless car research, a single document is a helpful read to keep track of what’s going on.

I’ve used the report to frame some of my own observations of the mobility space, as it stands, rather than a simple review of the report. So, to see HERE Mobility’s own take, you’ll need to download the report (signup link above).

Mobility + Cities = MaaS, Right Now

The report is clear that Mobility as a Service (MaaS) is the current driver of mobility research. That is, shared assets are the way of the future. When living in a dense city of the future, only the lucky few will have space for a car, an electric bike (and easy access to a workshop to fix it). Moreover, even if you do, parking it at the other end of your journey will be increasingly tough.

As a personal example (not in the report), 22 Bishopsgate in London, a tower under construction in the City of London, will have a daytime population of 12000, but will have 4 disabled car parking spaces, no regular ones, and 1700 bicycle parking spaces. The other 80-90% will arrive by public transport. Great – but the trains and tubes of London don’t have much in the way of spare space for the extra people at this and other developments. So, MaaS will become increasingly important in such an environment. You need a bike or would prefer a private ride to a meeting? A fleet of cabs or electric bikes are at your service. The system is patchy now, with rival operators of both modes not particularly integrating well – but the options are there and will only become more important – and their integration is crucial for a useful system that serves all. This is an obvious point but also one that HERE Mobility’s business is staked on – as it aims to become an honest broker of MaaS services rather as a provider itself.

The report emphasises that while MaaS technology is going to have to get smarter – we are going to have to get better at utilising the newer ways of moving through the urban environment, too. The report points out too three technology components of MaaS – the backend crunching big data to create a smart fleet and smart usage of it, a mobile app so the user can get information on MaaS options and perform transactions, and the asset itself having technology, being aware of what it is, where it is, and what it is capable of doing – a so called Internet of Things (IoT) platform. For example, your electric bike (aka pedelec) needs to have a good idea of its remaining battery range and whether it is inside an allowed operating area.

Design Globally but Think Locally

Another key point as that the US is not Europe (and neither are Asia, I would add) – and so MaaS solutions in one of these regions is not necessarily going to ride in the other. Another personal example would be bikeshare.

In Europe, we had Asian-origin bikeshares arriving in 2017-8 (Ofo, Mobike and oBike to name but three) but European and Asian cities and city cultures are fundamentally different. European cities tend to not have the huge pavements of Asian cities or huge roads of American and Asian cities, but we do tend to have a problem with vandalism and theft at a level that is less seen certainly in much of Asia. So, a one-size-fits-all bikeshare is not going to work here.

Similarly we are currently having a wave of US-origin bikeshares and escootershares (Bird, JUMP and Lime). Again, narrow pavements may struggle with the physical equipment, although at least technologies have improved to secure assets more effectively.

HERE Mobility’s report uses the example of the fundamental difference of European and US transport networks – with US cities typically being more car-designed, with wider, straighter roads, while European cities have often had a bigger focus on public transport, such as bus lanes or subway networks. If MaaS is going to come in and act as a complement to both types of cities, then it has to be adapted accordingly. Regulatory differences in the regions are also a factor – while the US has been keen to lead on autonomous vehicle research but introducing sections of public roads in some cities an states where such vehicles can be trialled, European cities often restrict cars of all sorts from large parts of their city centres.

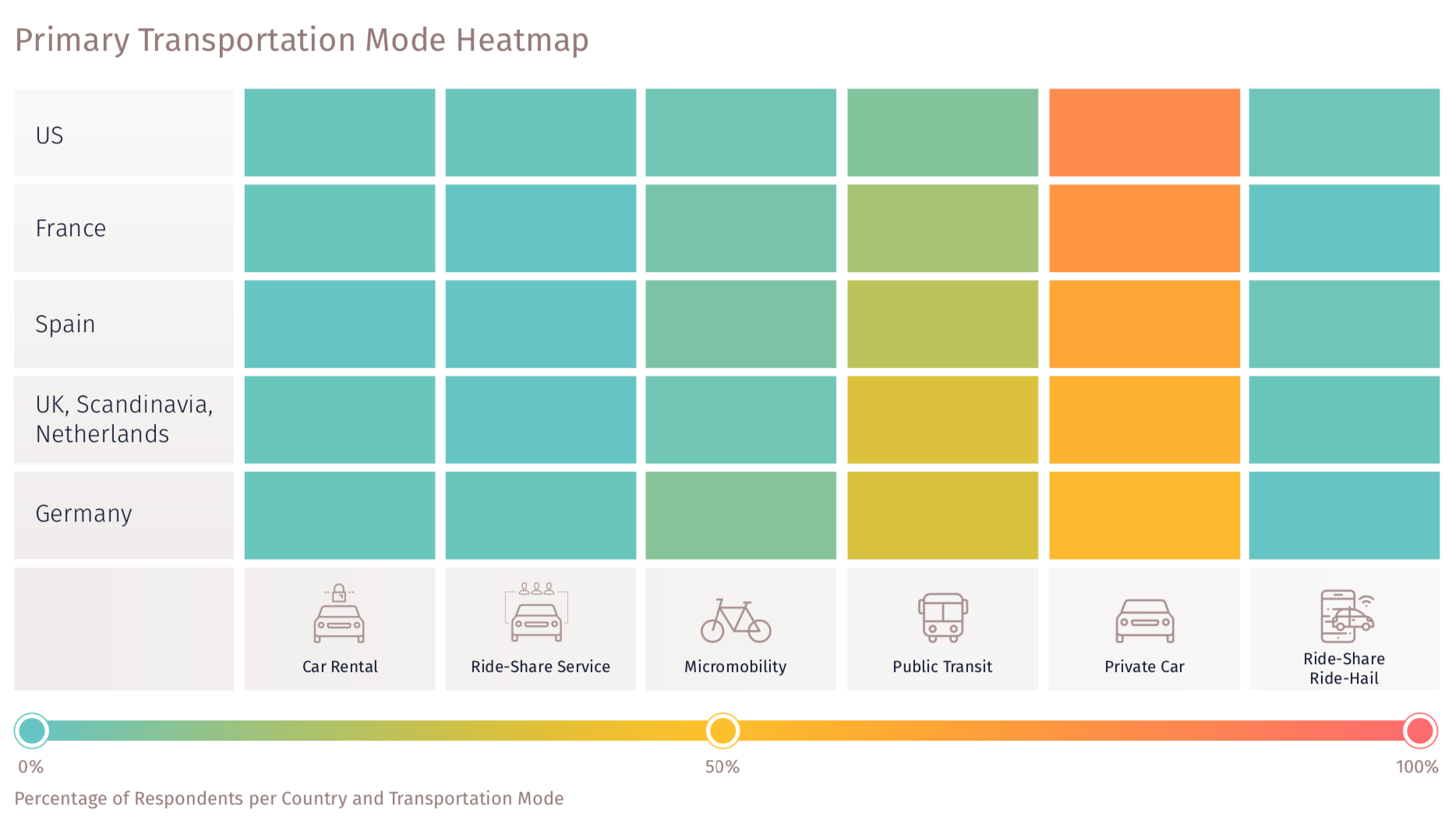

The report’s most interesting section disseminates a survey of over 20000 people, around 50% in each of the US and Europe. Within Europe, they split out northern Europe (UK/Scandinavia/Netherlands) from the big continental players (France/Germany/Spain).

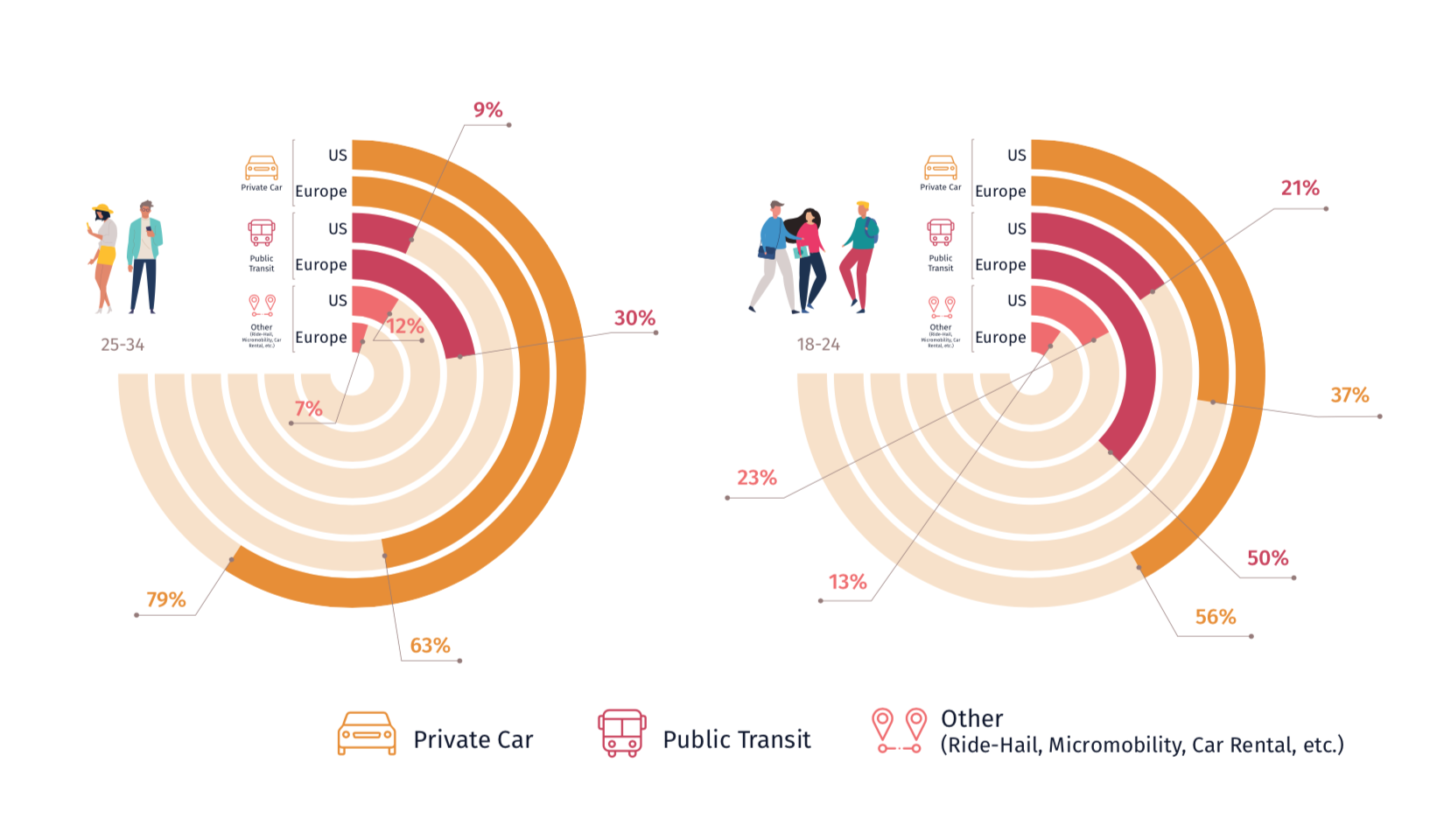

The differences between US, northern Europe and southern Europe are noticeable. Unsurprisingly the car dominates as the “primary” transportation mode in all three regions. In Europe a significant minority use public transport, and in continental Europe in particularly, micromobility also makes an appearance, indicating that Germany, France and Spain are ahead of the game not only with respect to the US but with their more northern neighbours. The other modes in the survey: car rental, ride hail and rideshare, have very low usages throughout the surveyed regions. The survey also breaks down by age group across each region and mode type, with the only significant difference being the youngest group (18-24) using public transport a lot more than the other groups – and US 18-24 year-olds using rideshare/micromobility noticeably more:

Transport App Consolidation

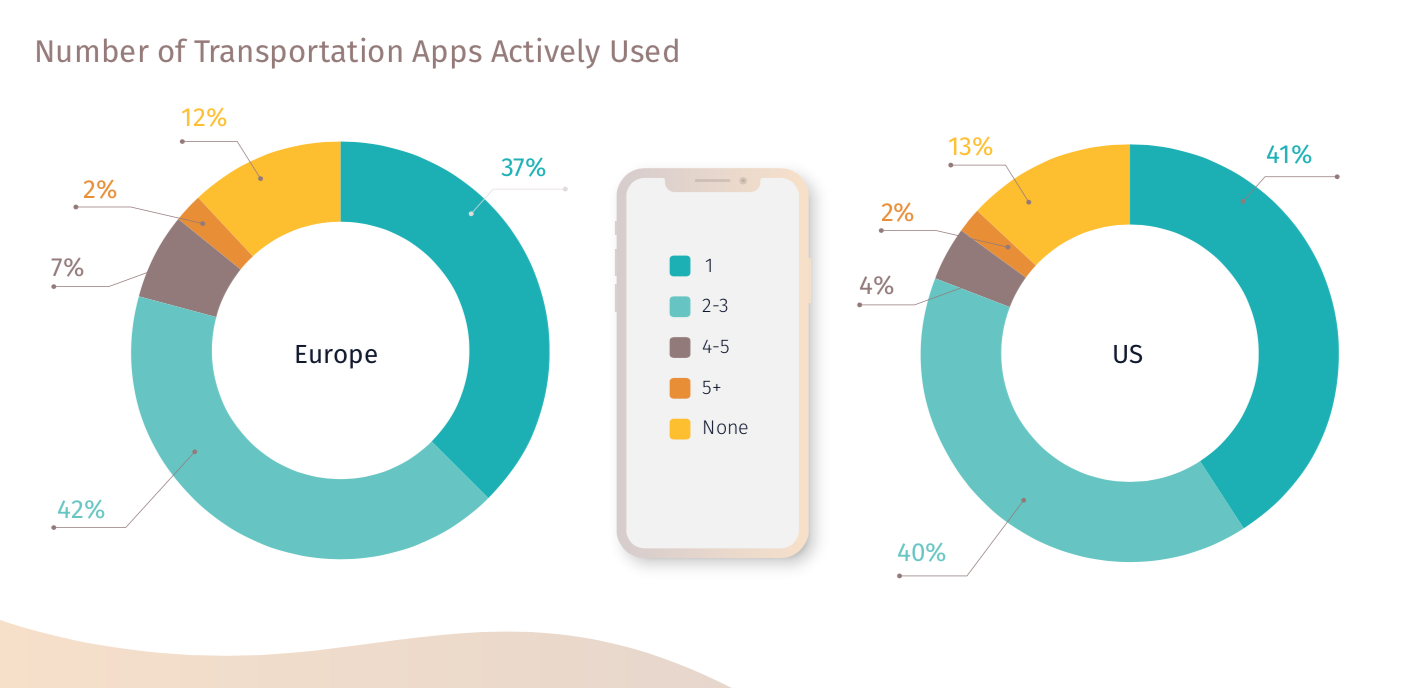

As mentioned above, HERE Mobility is aiming to be a “neutral” MaaS marketplace and so the final part of the survey focuses on the current situation on many people’s mobile phones – multiple apps needed for utilising all the transportation options in a city, along with measuring the desire for such a consolidation for service discovery and payment:

The final part of the report summarises the survey looks to the future. The authors note that it’s not all about price and that a more expensive but higher quality commute, if suggested by an app, might win out. Users generally also are not going to keep multiple transportation apps on their phones although they may try them out for a limited amount of time. And finally, private car usage is very much expected to continue to decline. The report sites Whim, a Helsinki based system that integrates all MaaS modes, from multiple providers, into a single app, is resulting in some very positive outcomes after only its first year of operation.

Here in London, and again focusing on the bikeshare services here, we are seeing some limited horiztonal and vertical consolidation, but we are a long way from rival services sharing their provision data. In terms of apps showing multiple services:

- Uber has its JUMP bike service, and Transport for London (TfL)’s open data public transport information, integrated into its main app.

- Google has included the TfL public transport data along with TfL’s (open data) bikeshare (through an ITO data brokerage agreement) and Lime bikeshare, and Uber and a couple of other cab and rideshare servies, into its app, although not Uber’s bikeshare. Apple Maps is similar.

- CityMapper has Mobike, Lime and Santander Cycles bikeshares, but not Uber’s JUMP, along with TfL data but no cabs.

- TfL’s own journey planner just includes its services.

- A number of smaller services (e.g. London’s Beryl Bikes) have started to publish location information in open data formats but these are generally below the radar of multi-option aggregators and so have not yet been adopted.

- Transactions (i.e. payment) involve, in almost all cases, the user getting redirected from their planning app to the providers app, with the notable exception of CityMapper and TfL services – but if you are signed up for their “CityMapper Pass”

So, a long way to go in London and – indeed – the rest of the world.

Thanks to HERE Mobility for sending me a copy of the report.