[Updated 11/8: Bird Liverpool demo]

[Updated 12/8: Aylesbury and High Wycombe planned trial]

[Updated 14/8: Zipp approved]

[Updated 19/8: Lime app showing Birmingham as an area of (planned) operation?]

[Updated 26/8: Beryl approved]

It’s been over a month since rental eScooters have been legal on public roads and cycle paths in the UK. Since then, one trial has started and a number have been announced, with a number of eScootershare operators also signaling intent without naming specific cities (by joining the CoMoUK charitable organisation and/or announcing that their vehicles have been approved for use with the trials by the Department of Transport.) Already, a number of differences in the implementations are appearing. To date:

Trials Launched

- Middlesbrough (Ginger). Part of a wider Tees Valley trial. Painted hubs. Around 50 eScooters in 3 hubs. £2/20 min. Max speed 12mph (DfT allows up to 15.5mph). Over 18s (DfT allows over 16s). Helmets advised but not mandatory. Ginger were quick out of the blocks with a system based on the Joyride platform – a slightly unfortunate name. The fleets appears to be only operational from 9am to 5pm, so not useful for people commuting. Middlesbrough is not a tourist city so one does wonder who therefore is their intended use base? As the first one, there has been a lot of media attention on any “incidents” which have included under-age users in shopping centres and users on the motorway – such locations presumably fixable with more careful geofence specification. The under-age issue is trickier – Ginger doesn’t allow under 18s – so something isn’t working quite right. Perhaps more worryingly, the fleet is already shrinking, with around 25 available. Hopefully the other 25 aren’t already at the bottom of the River Tees. Or maybe they are seeing high maintenance needs.

Trials Announced

- Hartlepool (Ginger). Part of a Tees Valley trial, however its trial has been delayed indefinitely as Ginger work out the issues raised with the Middlesborough part of the trial. There are also potential political issues, with the local MP not enthusiastic.

- Darlington (Ginger). Part of a Tees Valley trial. Specific launch not yet announced.

- Cambridge (Voi). £1+20p/min. Helmets mandatory (not required by DfT rules). Of note, Voi will be rolling out pedelecs at the same time. Cambridge has already had Mobike and ofo bikeshares, both of which have closed.

Peterborough (Voi).This has been announced by some media however I think this is confusion over the authority name that covers the Cambridge trial above.- Northamption(shire) (Voi). Not yet announced except by a Business Insider article.

- Milton Keynes (Lime). 250 escooters. Lime already have a fleet of dockless pedelecs in Milton Keynes so have “on the ground” experience of the challenges of managing self-service electric rental vehicles in a UK city.

- Milton Keynes (Spin). MK is the first multi-operator trial.

- Milton Keynes (Ginger). (h/t Zag)

Additional Areas Interested

Noteably, almost all these areas have had bikeshare systems that have failed in the past, often due to vandalism.

- Liverpool (tender live) (they have an existing bikeshare that has struggled with vandalism/theft in the past – so is operating with around 25% of the bikes it should be – but despite this is very popular) – Voi?

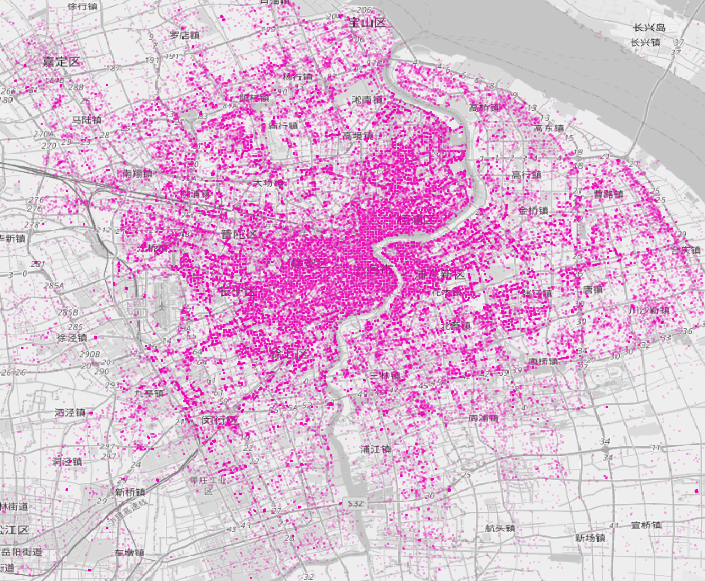

- West Midlands (including Birmingham, Coventry, Wolverhampton and Dudley) – Lime is interested and is showing the area in its app currently – (had a small bikeshare pilot that ended acrimoniously with both sides criticising each other in the media).

- Leeds (ofo failed to roll out a promised dockless bikeshare here)

- Newcastle (a Mobike dockless bikeshare pulled out due to vandalism)

- Nottingham (has a very small, but still operating, bikeshare)

- Derby (had a small dockless pedelec bikeshare that closed due to vandalism)

- Bristol and Bath (free-floating tender live – September launch) (Voi?) (Bristol has a currently operating dockless bikeshare, Bath has had multiple small ones that have closed due to lack of funding)

- Southampton (Yobike dockless bikeshare pulled out here due to vandalism)

- Portsmouth (tender live) (Portsmouth has been trying to set up a bikeshare since 2012, without success.)

- Essex (possibly Ipswich, which had a dockless bikeshare “Urbo” which closed shortly after launching and failed to reopen as promised. It was never clear why they didn’t but I suspect it was because almost no one actually used the bikes. The unique feature of Urbo Ipswich is the bikes had to be secured to street furniture using a secondary lock.)

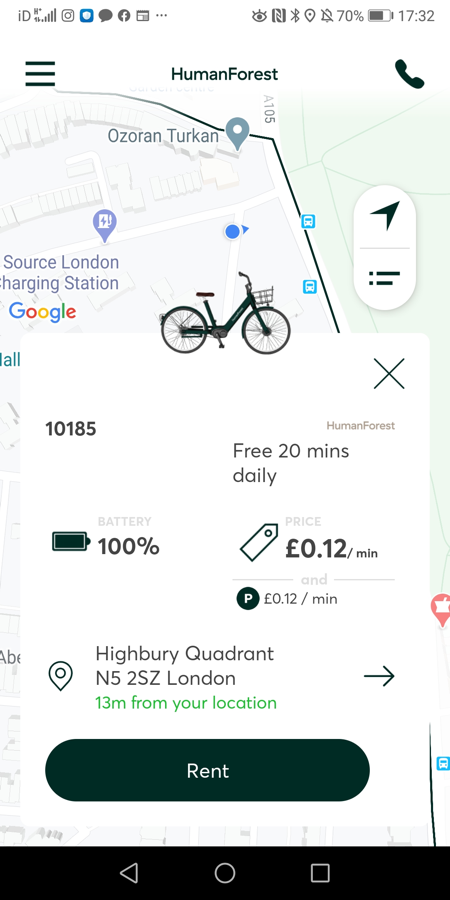

- London (presumably some boroughs and not others. Numerous failed bikeshare systems here – but also plenty still going.)

- Aylesbury and High Wycombe

- Redditch

- Norwich – Beryl (who already run bikeshares in Norwich, Watford, Hereford and Bournemouth)

Operators Approved

All the above (presumably), plus:

Operators with CoMo Membership

All the above, plus:

- Augment

- Bird (who until recently had a small private-land-only trial in London’s Olympic Park, and are in talks for the Liverpool tender.

- Helbiz

- Hive (part of the Free Now taxi platform)

- Moo

- Neuron

- Tier

- Wheels

- Zwings “Already working with 3 councils for either e-bike or e-scooter trials”

Operators Interested

All the above, plus:

- Knot

- Ride Gotcha

N.B. Some operators may be planning long-term rental schemes, rather than escootershare systems.